MARTIN WOLF

April 18, 2023

Inflation’s comeback has changed the world — but how much we don’t yet know.

The return of inflation has surprised many, including central bankers. So has the resulting rise in nominal interest rates. These surprises have brought others with them, notably a mini-shock to banking.

The question, then, is: “What next?” Will inflation subside to ultra-low pre-Covid levels or will it be a lasting problem, as in the 1970s and early 1980s? What, too, will happen to interest rates?

As Stephen King, adviser to HSBC, notes in We Need to Talk About Inflation, many were too complacent about the possibility of inflation’s return. As he notes, too, once inflation and, above all, inflationary expectations are entrenched, they become very painful to eliminate. Have we reached that point? Or do our institutions still have enough credibility and is enough of the inflation still transitory for us to be able to return to low inflation at a low cost?

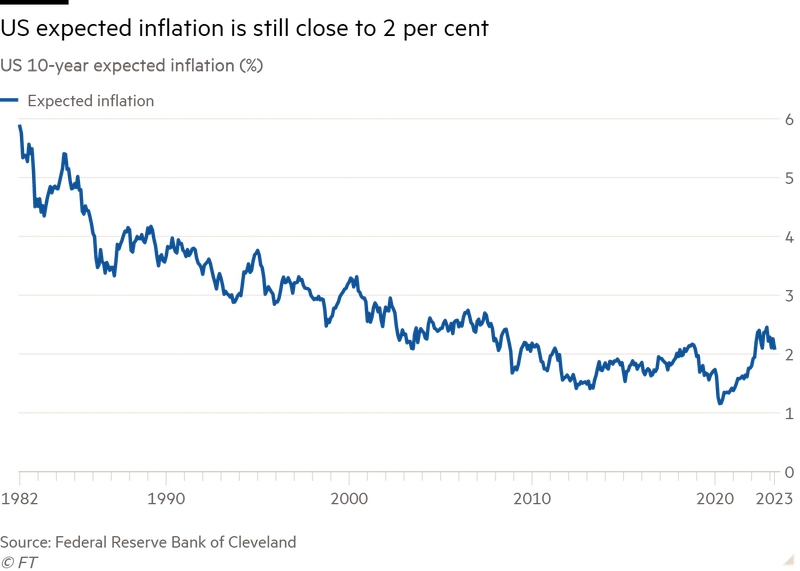

We are, in my view, more likely than not to return to inflation at around 2 per cent a year, or perhaps just a little bit higher. This is also what markets expect: according to the Federal Reserve Bank of Cleveland, US expected inflation is 2.1 per cent, almost exactly in line with the target. This shows confidence that the target will be delivered. The inflation risk premium is also estimated at 0.5 percentage points, which is in line with historic valuations.

There are two (overlapping) arguments why this might prove too optimistic. One is that supply conditions have become more inflationary. De-globalisation and other shocks have permanently lowered the elasticity of supply of key inputs. That will raise the costs of keeping inflation down. The other is that the political economy of curbing inflation has worsened. Thus, the public cares less about inflation now, partly because it has no memory of a long period of high inflation. Moreover, governments want to lower their indebtedness, which is now far greater than 15 years ago, without curbing fiscal deficits. Finally, the inflation genie is now out of the bottle. Putting it back in will hurt.

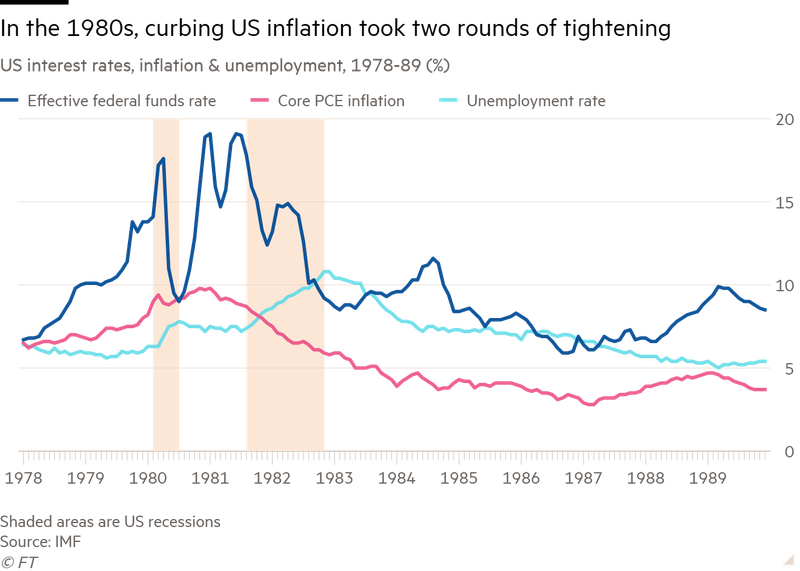

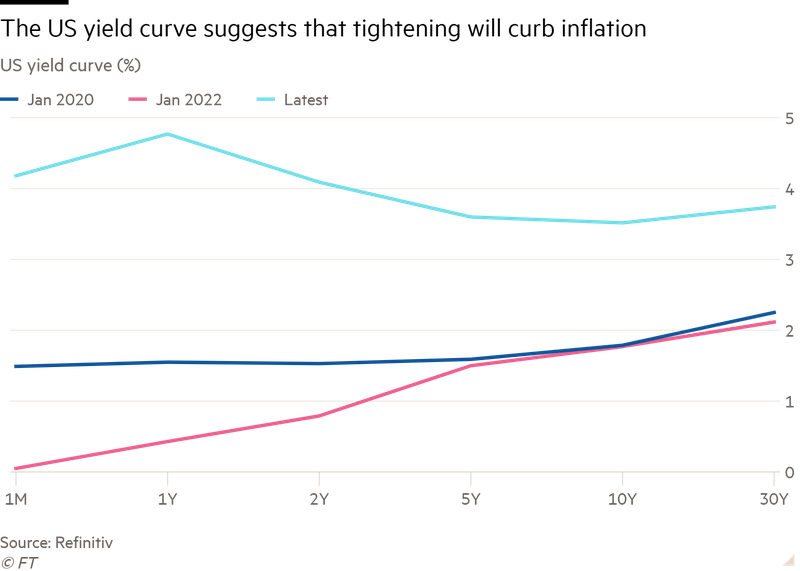

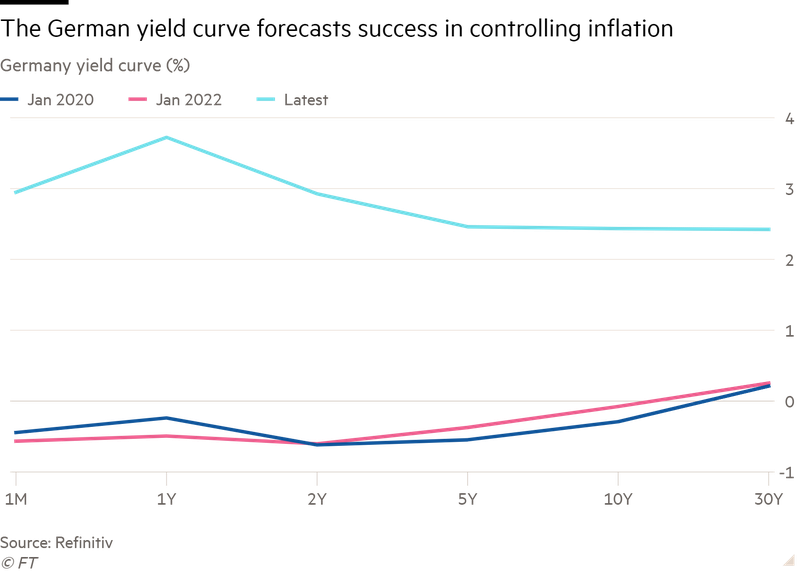

I remain unconvinced. Obviously, there is no necessary link between supply and inflation, since demand also matters. Provided aggregate demand grows in line with potential output and the structure of output is reasonably flexible, specific constraints are perfectly consistent with low overall inflation. Moreover, those responsible for monetary policy will not want to go down in history as those responsible for losing monetary stability. Last but not least, they know that it will be far easier to crush inflation now than have to tighten yet again later. (See charts.)

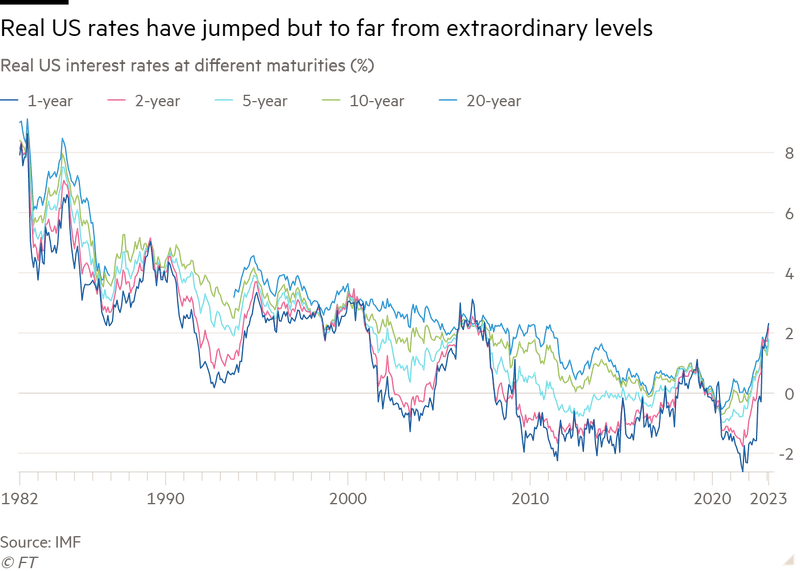

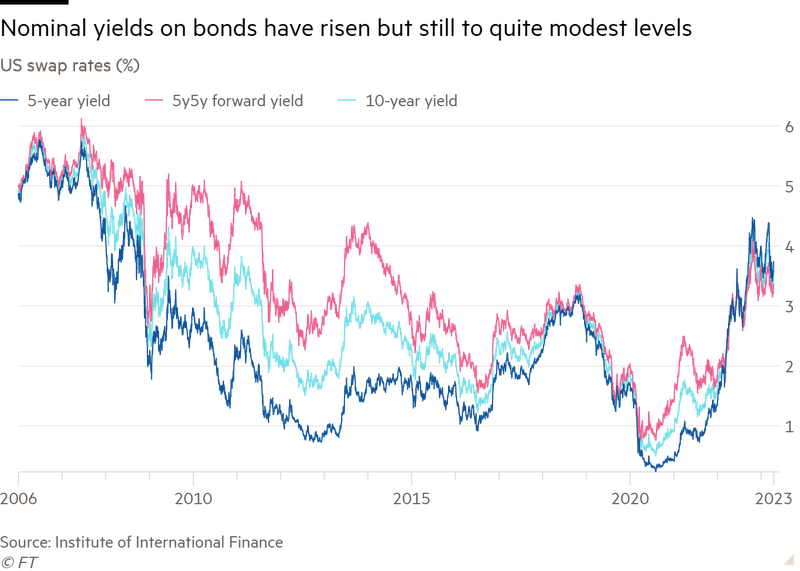

Assume that this is correct. Then the inflation components in nominal interest rates will not be permanently raised. But what about the real element? Real interest rates fell for a generation, before reaching negative levels during the pandemic. Since then, they have recovered sharply. What happens now?

In its latest World Economic Outlook, the IMF addresses this question by investigating the “natural rate of interest”, which is defined as “the real interest rate that neither stimulates nor contracts the economy”. That is also the rate at which one would expect inflation to remain stable (in the absence of shocks). The natural rate is not directly observable. But it can be estimated. The main conclusion of its analysis is that “once the current inflationary episode has passed, interest rates are likely to revert towards pre-pandemic levels in advanced economies”. After the recent shocks, then, real and nominal rates will fall back to where they were in 2019. In particular, it expects the effect of further ageing to be modest, as is also the (opposite) effect of higher public debt.

In March, two leading macroeconomists, Olivier Blanchard and Lawrence Summers, debated this issue in detail for the Peterson Institute for International Economics. Of the two, Blanchard came closest to the IMF position. Summers, who had reintroduced the idea of “secular stagnation” into the policy debate in 2015, has now changed his mind, arguing that rates will be significantly higher than in the recent past.

The difference is not huge. Blanchard argues that real interest rates will remain below the real rate of economic growth, which is crucial for debt sustainability. He does not suggest that they will return to negative levels. Summers thinks they will somewhat be higher than the Fed’s estimate of a natural rate of 0.5 per cent. One reason why real rates will be higher than before, they agree, is higher investment in the energy transition. Another is the need to spend more on defence. Higher public debt may also raise real rates, though inflation is eroding debt away.

These two disagree, however, on whether the persistent demand reflects temporary (Covid-related) factors or more durable strength. They disagree on how far risk aversion will keep yields on safe assets low. They disagree on whether ageing will raise savings further. And they disagree, too, on the likely impact of public debt on interest rates. In all these respects, Blanchard takes a position that justifies lower natural rates and Summers one that justifies the opposite. His position is close to that adopted by Charles Goodhart and Manoj Pradhan.

So, assume inflation will decline to 2-3 per cent. Assume, too, an equilibrium real rate of interest of 0-2 per cent. Then nominal short rates would be 2-5 per cent and, given risk premiums, longer-term rates would be 3-6 per cent. At the lower end, debt sustainability would be simple. At the higher end, it would be a challenge. This range of uncertainty is large. Yet reality could still be different.

The return of inflation has changed the world. The question is how much. It is one to which time will give its answer. My own guess is not decisively so.

Copyright The Financial Times Limited 2025

© 2025 The Financial Times Ltd. All rights reserved. Please do not copy and paste FT articles and redistribute by email or post to the web.

This article was legally licensed by AdvisorStream