By Tom Orlik, Ana Galvao, and Scott Johnson

Nov. 3, 2022

For those with a short memory, it’s tempting to blame the world’s problems on surging populism. In this telling, Brexit, the US-China trade war and America’s botched response to Covid-19 become part of a single narrative. Rabble-rousing leaders in the mold of Donald Trump pander to the worst instincts of the body politic, expert voices are drowned out in the echo chamber of social media, and the economy pays the price.

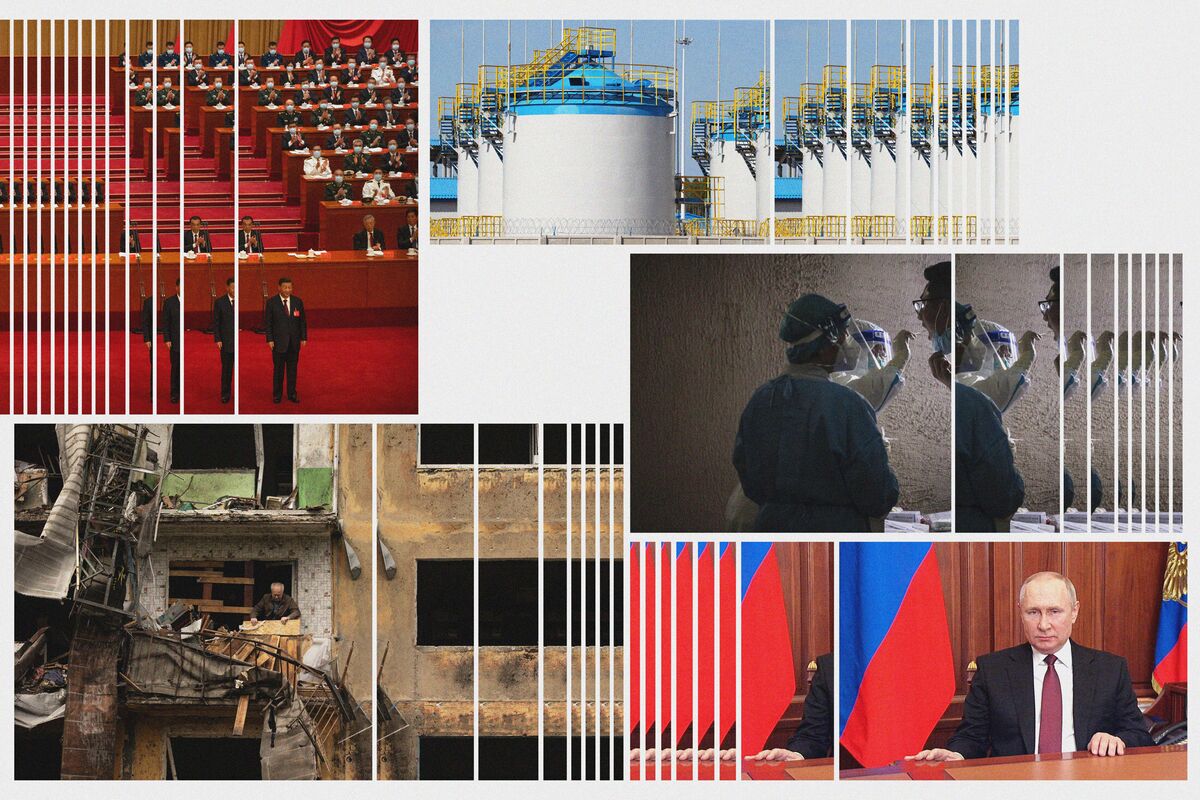

Photo illustration: 731; photos: AP Photo, Bloomberg, Kremlin, Reuters, Zuma Press

The trouble with that version of recent history is that though they’re responsible for some real doozies, populists don’t have a monopoly on policy failure. Remember the global financial crisis? The European sovereign debt crisis? The stagnation of middle-class wages and upward spiral in inequality? All major shocks to the system. All taking place when the supposed grown-ups were in charge.

Perhaps it makes more sense to say both populist and mainstream politicians are grasping for a response to seismic shifts in the way the world works. Indeed, in the conflict that underlines so much of today’s global tension—the battle for supremacy between the US and China—it turns out the rival US camps have basically the same approach.

In 1989, anticipating the fall of the Soviet Union, political scientist Francis Fukuyama declared “the end of history,” with the triumph of democracy and capitalism over authoritarianism and state control. That happened to be premature.

The rise of China in the past three decades has seen the balance of global power shift away from democratic free-market countries. Bloomberg Economics’ projections suggest the trend will continue, with the share of global gross domestic product from Europe, the US and Canada sliding from 59% in 1989 to 41% in 2022, on a path to 24% in 2050. For the global economy, it makes sense to think about that shift as triggering two types of problems: short-fuse blowups when tensions between the two sides erupt, and slow-burn costs as they move farther apart.

An example of the former is Russia’s invasion of Ukraine. It was only a few short weeks after President Vladimir Putin stood next to his Chinese counterpart, Xi Jinping, and declared a “no limits” partnership that the tanks rolled across Ukraine’s border. Even if China didn’t sign up to support the invasion, Putin could at least take the bet that one of the world’s two great powers would stay neutral—limiting the impact of any blowback from Europe and the US.

And it wasn’t just China. India, now the world’s fifth-largest economy, has conspicuously failed to pick a side. In Brazil, newly reelected President Luiz Inácio Lula da Silva has said Ukrainian President Volodymyr Zelenskiy shares the blame for the war. And Saudi Arabia has thumbed its nose at US requests to offset the effect of Putin’s energy embargo by keeping the oil flowing. The message: A world where the US and its allies are in retreat is a world where illiberal states are empowered and destabilizing shocks follow.

If tremors are going to keep coming hard and fast, it will be useful to have a rule of thumb for estimating their impact. As a first step, US Federal Reserve economists Dario Caldara and Matteo Iacoviello have used a tally of newspaper articles to create an index of geopolitical risk. Bloomberg Economics has plugged that index into a model to show how shocks such as military buildups, terrorism and war affect the US economy. The results show that a geopolitical shock of the magnitude seen in the first quarter of 2022—when Russia invaded Ukraine—leads to a 1.3% decline in US investment, from which it takes three to five years to recover. GDP decreases 0.3%, inflation rises 0.3%, and the S&P 500 declines 1.8%.

Stating the obvious, a model based on a standardized measure of geopolitical risk misses the specific characteristics of crises. Russia’s invasion of Ukraine hit the global supply of energy and agricultural commodities. A war in Taiwan would cripple electronics supply chains. Still, the results provide a useful starting point.

The current weakness in the global economy provides another way of thinking about the short-term effect of geopolitical shocks. Russia is already in recession. Europe is about to follow, largely because of the cutoff in gas supply. In the US, inflation—also in part a consequence of the Ukraine war—has pushed the Federal Reserve onto its most aggressive tightening trajectory since the 1980s. A Bloomberg Economics model suggests that’s very likely to tip the economy into a downturn in 2023, throwing millions out of work.

The impact of slow-burn shocks isn’t as immediate but, over time, can be equally severe. The reason is simple. By allowing the free flow of goods, capital and labor, global ties drive higher growth and help keep a lid on inflation. Fracturing ties throw that dynamic into reverse, with restrictions on cross-border trade, investment and migration denting growth and putting upward pressure on prices. In the UK, Bloomberg Economics estimates that Brexit has taken the economy’s annual growth potential down from 1.7% to 1.2%. Over a decade, that adds up to £800 billion ($917 billion) in lost income.

A similar dynamic is playing out in US–China relations. First came the Trump tariffs. Some hoped the Biden administration would bring a thaw. In fact, the chill has increased. Not only has the Biden team left tariffs in place, but it’s gone further and cut off access to leading-edge semiconductors—a move that aims to turn China into a kind of Amish community, its technological development frozen.

The breakdown in trade and technology flows also raises the prospect of higher prices. Russia cutting off Europe’s gas supplies has demonstrated that dynamic on steroids. A world where US consumers can no longer tap cheap goods from China wouldn’t light an immediate inflation fire, but it would provide the dry kindling in which one could break out.

Politics are even harder to forecast than economics. It’s possible that a Russia humbled in Ukraine and a China focused on internal challenges will dial down geopolitical tensions. It’s also possible that voters will elect moderates promising good governance, as the US did with Joe Biden. Some regions stand to gain as trade is rerouted away from geopolitical fault lines. Maybe parts of the developing world will benefit if rival superpowers try to buy allegiance with investments—a new US Marshall Plan to rival China’s “Belt and Road” initiative.

The lesson of the past few years, though, is that anyone waiting for a return to geopolitical stability may be waiting a long time. History is back, and that’s bad news for prosperity.

© 2024 Bloomberg L.P.